Xu Jiayin’s Delaware Trust Faces Cross-Border Claims from Hong Kong Courts — Is a DAPT Still a Good Trust Option?

Recent media reports indicate that Xu Jiayin has established a trust structure in the United States, with Delaware as the governing jurisdiction, which has now drawn attention due to cross-border enforcement efforts and judicial scrutiny from Hong Kong courts. Understanding—and knowing how to properly use—trust structures to mitigate asset risk is an essential skill for high-net-worth individuals.

This article introduces the fundamental concepts of Domestic Asset Protection Trusts (DAPT) and organizes the five key questions most frequently raised by clients when evaluating whether to establish such a trust. By reading this article, readers can quickly gain a foundational understanding of DAPT and its role in asset protection planning.

What Is a DAPT?

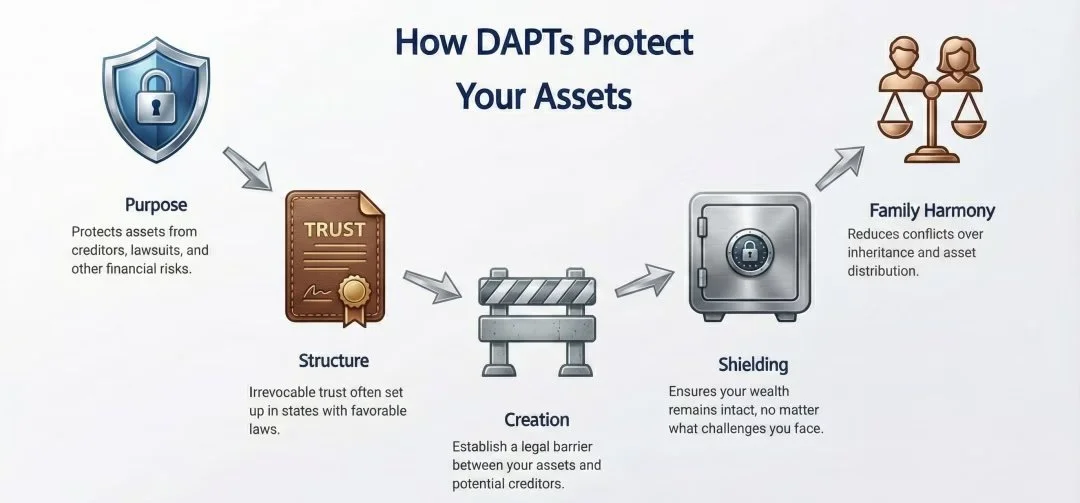

A Domestic Asset Protection Trust (DAPT) is a legally recognized trust structure in certain U.S. states. For individuals seeking proactive planning to protect personal and family wealth, a DAPT offers a powerful legal tool designed to mitigate exposure to future creditors, potential litigation, and unexpected financial risks.

How to Choose the Right Jurisdiction for Establishing a DAPT

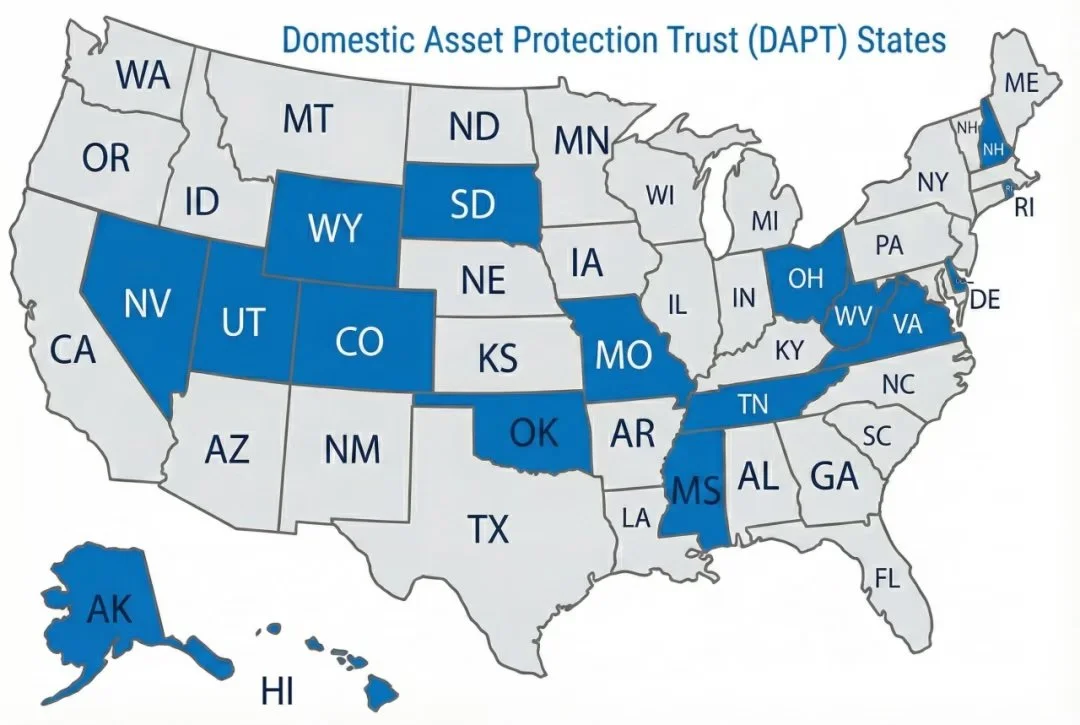

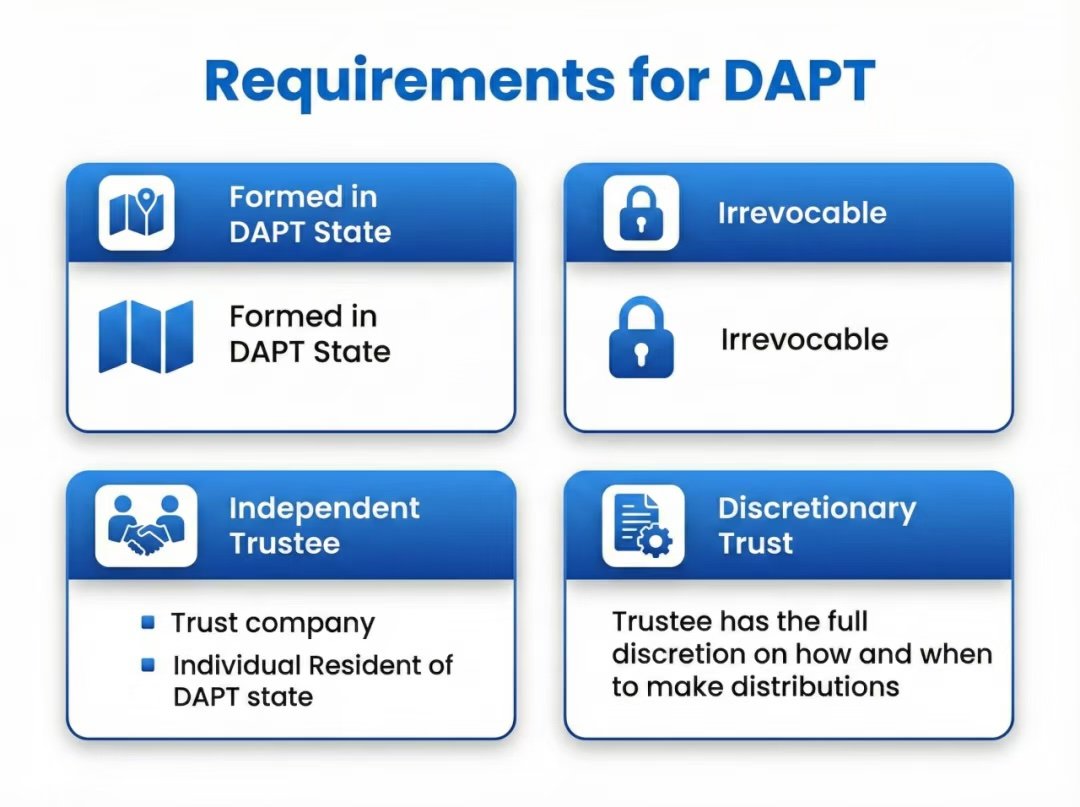

As of 2025, twenty-one U.S. states permit the establishment of DAPTs, but the legal rules governing them vary significantly by state. When selecting a jurisdiction, key considerations include statutes of limitation, creditor rights, and enforcement mechanisms.

Among these jurisdictions, Nevada and Delaware are the two most commonly selected, though they differ in several critical respects.

Nevada

Nevada imposes the shortest statute of limitations for creditor challenges. Existing creditors must generally bring claims within two years of the asset transfer (or within six months of discovery, if later), while future creditors are likewise limited to a two-year window. Once this period expires, Nevada law makes it extremely difficult to unwind transfers made to a DAPT.

Delaware

Delaware allows creditors a longer period to assert claims. Existing creditors may challenge transfers within four years of the transfer, or one year from discovery, whichever is later. Future creditors must assert claims within four years of the transfer, without any discovery-based extension.

At first glance, Delaware appears to provide creditors with a broader window for action than Nevada. However, Delaware offers other advantages: it has permitted DAPTs since 1997, two years earlier than Nevada, and has accumulated a deeper body of trust-related case law. As a result, Delaware DAPT structures may be more legally robust in practice.

Overall, both Nevada and Delaware offer clear statutory authority, mature trustee industries, and detailed rules governing self-settled asset protection trusts. The ultimate choice between the two typically depends on the client’s timing, risk tolerance, and preferred balance between flexibility and certainty.

How Does a DAPT Address “Fraudulent Transfer” Issues?

No DAPT can protect assets from existing debts or from transfers made with the intent to defraud creditors. Each state applies its own standards for determining whether a transfer is improper.

Nevada’s Standard

Nevada requires creditors to prove actual intent to hinder, delay, or defraud creditors, and such intent must be established by clear and convincing evidence, a relatively high legal standard.

Delaware’s Standard

Delaware permits claims based on both actual fraud and constructive fraud. Under Delaware law, a transfer may be challenged if the settlor did not receive reasonably equivalent value and was insolvent at the time of the transfer or became insolvent as a result of it (see In re Syntax-Brillian Corp., 573 F. App’x 154, 158 n.4 (3d Cir. 2014)).

Neither framework is inherently superior. Nevada’s approach is more stringent, but once the statutory challenge period expires, the resulting protection is stronger. Delaware’s framework is broader and more flexible, making it potentially better suited for clients who value a long-established legal tradition, extensive case law, or who already maintain business interests in Delaware.

Can a DAPT Protect Against Spousal or Child Support Claims?

State laws vary significantly with respect to family support obligations.

Delaware

Delaware recognizes certain categories of “exception creditors,” including claimants seeking alimony or child support. This means that even after the general statute of limitations for challenging trust transfers has expired, creditors enforcing these statutory obligations may still reach trust assets (see IMO Daniel Kloiber Dynasty Trust, 98 A.3d 924, 941 (Del. Ch. 2014)).

Nevada

Nevada law does not automatically exclude spousal or child support claims from DAPT protection. Case law suggests that when such obligations were not clearly established or known at the time the trust was created, Nevada courts have upheld the asset protection function of the trust (see Klabacka v. Nelson, 394 P.3d 940, 951 (2017)).

Accordingly, Nevada provides stronger protection in this area than many DAPT jurisdictions, including Delaware. For clients concerned about existing or potential family law obligations, the choice between Nevada and Delaware can be particularly significant. Regardless of jurisdiction, careful legal planning remains essential.

If I Live in California, Can a DAPT Still Protect Me?

Clients residing in states that do not recognize DAPTs—especially California—often ask whether a DAPT established in Nevada or Delaware will be respected in their home state.

The core principle is that a DAPT is generally governed by the law of its establishing state. However, this does not guarantee that a California court will apply out-of-state law. California courts may instead apply California public policy, which is generally unfavorable toward self-settled trusts. This risk exists regardless of the chosen DAPT jurisdiction or the quality of drafting.

That said, DAPTs are not categorically ineffective for California residents. The key is to strengthen the substantive connection between the trust and the establishing state, such as by minimizing the settlor’s ties to California, appointing professional trustees located in the DAPT state, and keeping trust assets primarily within that jurisdiction.

A cautionary example is In re Huber, 493 B.R. 798 (Bankr. W.D. Wash. 2013), where the court declined to apply Alaska law because the Alaska DAPT lacked sufficient substantive connections to the state. This case underscores the importance of ensuring real and meaningful ties between the trust and its governing jurisdiction.

In short, a well-structured DAPT—whether established in Nevada, Delaware, or another authorized state—can still significantly increase the difficulty and cost of creditor recovery, thereby providing meaningful asset protection in practice.

Is a DAPT Better Than Using Life Insurance for Asset Protection?

Life insurance exemptions are primarily designed to protect beneficiaries. In many states, creditors cannot access death benefits after the insured’s death. However, during the insured’s lifetime, the cash value of a policy may be reachable by creditors unless protected by specific state statutes (see In re Monahan, 171 B.R. 710, 717 (Bankr. D.N.H. 1994)). Even when protected, the scope of such exemptions is often narrower than trust-based protections.

By contrast, DAPTs are specifically designed for asset protection. These statutes are intended to protect the settlor’s own assets (after the applicable time periods), not merely the assets of beneficiaries. This distinction is critical: life insurance protection is incidental, whereas DAPT protection is intentional and structural.

Conclusion

Returning to the news referenced at the outset, based on currently available information, a professional assessment suggests that Xu Jiayin’s Delaware trust may face challenges in local courts asserting that the asset transfers were invalid.

The core value of a Domestic Asset Protection Trust (DAPT) lies in its ability to provide a proactive, structured tool for forward-looking wealth planning by selecting jurisdictions with mature legal frameworks, such as Nevada or Delaware. Its effectiveness is not automatic; it depends on carefully aligning individual risk profiles with state-specific legal features—such as statutes of limitation and treatment of family obligations—and reinforcing the trust’s substantive connection to its governing jurisdiction.

It must be emphasized that DAPTs are lawful tools designed to mitigate future risks, not to defeat existing creditor claims. Ultimately, a successful DAPT arrangement depends on thoughtful structural design, informed interstate legal selection, and timely implementation through comprehensive planning.