From Terraform Labs to TUSD: Constraints and Transformations Brought by the U.S. “GENIUS Act”

Behind the Issuance of “Decentralized” Tokens—Opaque Trust and Fund Structures in Reality

In recent years, two landmark incidents in the stablecoin sector stand out. The first is the collapse of Terraform Labs’ algorithmic stablecoin TerraUSD (UST) and its related assets; the second is the exposure of approximately $456 million in TrueUSD (TUSD) reserves that moved through offshore trust and fund structures before ultimately flowing into a high-risk entity in Dubai. A comparative view reveals a shared pattern: while these projects promoted narratives such as “decentralization” and “on-chain self-governance,” their real-world financial implementation relied heavily on traditional legal vehicles—overseas companies, foundations, trusts, and investment funds—whose disclosure and governance mechanisms lacked transparency. When markets reversed or internal governance failed, ordinary users could only reconstruct the truth afterward through litigation and media reports.

TerraUSD (UST) was marketed as an “algorithmic stablecoin,” designed to maintain a 1:1 USD peg via the dual-token mechanism with LUNA and arbitrage incentives, rather than through equivalent fiat reserves. In practice, entities such as Luna Foundation Guard (LFG) held large pools of Bitcoin and other assets off-chain to defend the UST rate in emergencies. Yet the operational details—asset deployment, risk controls, and reserve management—were not adequately disclosed. Consequently, after the de-peg in May 2022, these backup reserves could not prevent the death spiral, erasing roughly $40 billion in market value and leading to the total collapse of the Terra ecosystem.

The TUSD structure illustrates another extreme. Although presented as a fiat-collateralized stablecoin backed by one dollar per token, Techteryx’ disclosures and multiple reports indicated that the reserves were not simply kept in regulated bank accounts. Instead, funds passed through Hong Kong licensed trustee First Digital Trust (FDT) and Legacy Trust, entered Cayman-registered Aria Commodity Finance Fund (ACFF), and a substantial portion was transferred to Dubai-based Aria Commodities DMCC for high-risk trade and real-project investments. Only when the $456 million could not be redeemed—and the DIFC Court issued a global asset-freeze order against Aria Commodities DMCC—did holders and markets see a fuller picture of the reserve chain.

Issuer Domicile and Regulatory Vacuum: Singapore Terraform Labs vs. BVI Techteryx

From a corporate-law perspective, both Terraform Labs and TUSD employed classic cross-border mosaics.

Terraform Labs Pte Ltd was incorporated in Singapore as the core developer and promoter of Terra assets. The U.S. Securities and Exchange Commission (SEC) alleged that founder Do Kwon effectively sold products into the U.S. by promoting to American investors, hiring U.S. employees, and partnering with U.S. institutions, while misleading the stability of UST and its use in Korean payment apps. During operations, neither Singapore nor Korea had specific legislation governing algorithmic stablecoins—no clear rules on how LFG reserves should be managed, disclosed, or handled upon de-peg. Ultimately, Terraform Labs faced U.S. SEC fraud and disclosure actions, sought bankruptcy protection in 2024, and Do Kwon received severe criminal sentences in 2025. The process reflected after-the-fact securities enforcement rather than a dedicated ex-ante stablecoin regime.

TrueUSD (TUSD) became even more fragmented. Initially operated by U.S. TrustToken/Archblock, the business was sold in 2020 by TrueCoin LLC to Techteryx Ltd, a company registered in the British Virgin Islands (BVI). Techteryx then used Singapore, Hong Kong, and Cayman entities to take over offshore operations—minting, redemption, KYC/AML compliance, and reserves. Large USD assets were placed with Hong Kong licensed trustees FDT and Legacy Trust, then invested under ACFF. Plaintiffs claimed ACFF mandates were exploited to move funds into Dubai family-controlled Aria Commodities DMCC, creating massive liquidity and credit risk.

It must be stressed that many statements remain allegations; some institutions have denied wrongdoing and no final judgment has been reached. Nevertheless, from a regulatory standpoint, Hong Kong has not established U.S.-style payment-stablecoin reserve rules. Its trust oversight focuses mainly on AML, client-asset segregation, and general protections, offering limited targeted warnings on cross-border high-risk investments, related-party trades, and transparency. Such environments allowed “offshore trust + fund + family-related operator” schemes to endanger holders ex-ante unknowingly. Once risk erupted, loss of user assets was almost inevitable.

SEC Enforcement Role and the “Hard Constraints” of the GENIUS Act

From the U.S. legal lens, both projects touched American law to varying degrees.

Terraform Labs and Do Kwon were pursued by the SEC under fraud and unregistered-securities provisions. TrueUSD (TUSD), after Techteryx’ takeover, declared that it no longer offered services to Americans and has not been adopted by compliant U.S. exchanges such as Coinbase, leaving it in a regulatory gray zone outside U.S. borders.

Before 2025, the United States lacked a federal stablecoin act; authority was dispersed among SEC, CFTC, federal banking supervisors, and state trust regulators—another regulatory puzzle. Under such frameworks, ex-ante constraints on reserve assets, categories, and custody did not exist. Oversight centered on after-the-fact questions like “Were investors deceived?” but not “Are algorithmic mechanisms permitted?” or “Can reserves be invested in high-risk Aria-type entities?”

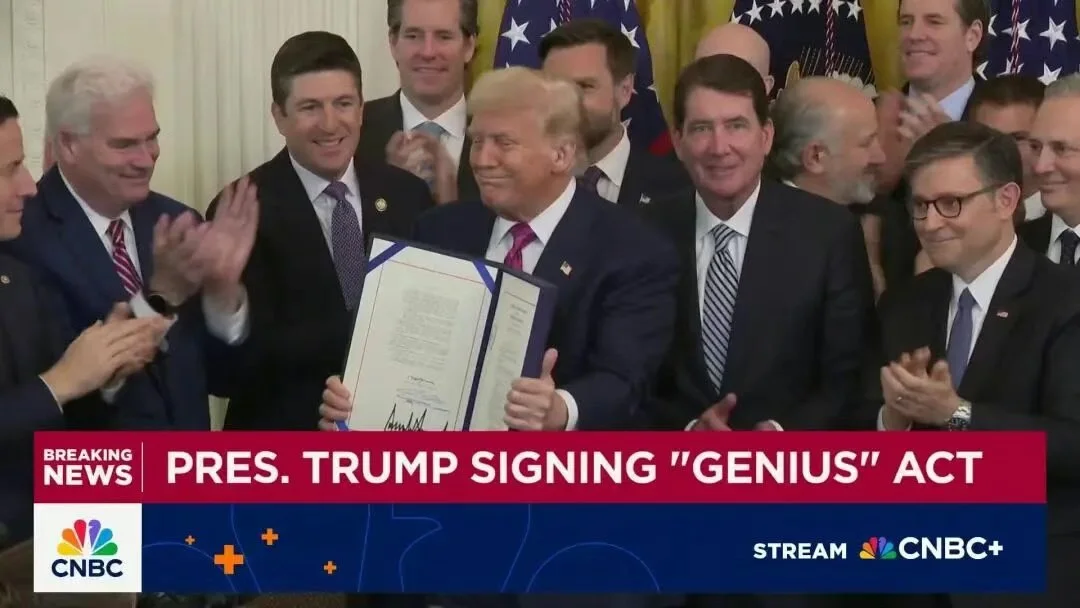

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025) aimed to fill this gap. It differentiates payment stablecoins from other crypto assets and requires that any issuer targeting U.S. persons must be a licensed issuer—federally or state-chartered banks or regulated trust companies. More critically, Section 4 mandates 1:1 authorized reserves and strictly limits “permitted reserve assets” to:

USD cash

Insured bank deposits

Short-term U.S. Treasuries and repos

Money market funds investing only in the above

Similar high-liquidity federal-government credit instruments approved by regulators

The Act also imposes frequent public disclosure, independent CPA reviews, and potential criminal liability for falsifying reserve reports. Under GENIUS rules, structures like those of Terraform Labs or TUSD—using offshore trusts and funds to channel user money into opaque high-risk pools—could hardly survive as compliant U.S. payment stablecoins.

GENIUS does not automatically govern all global stablecoins; its nexus is “issuance and promotion to U.S. persons.” If TUSD truly avoids U.S. touchpoints, it may remain outside GENIUS, yet any U.S. nexus would trigger the hard standards. Future U.S. compliant institutions and exchanges will screen stablecoins based on GENIUS requirements, indirectly reshaping global stablecoin “passport” distribution.

Regulation and Transparency for “Decentralized” Issuance Are Fundamentally Market and User Protections

The lessons from TerraUSD (UST) and TrueUSD (TUSD) demonstrate that, regardless of on-chain narratives, token issuance ultimately depends on highly centralized legal and custody structures. The core issue is not the existence of companies, foundations, trusts, or funds, but their use to build opaque, poorly audited money pools that convert users’ “1:1 safe reserves” into fragile exposures—algorithmic weaknesses, family-related-party risk, and concentration in high-risk asset schemes. When markets failed, on-chain crashes merely reflected losses already accumulated within offshore black boxes.

Therefore, imposing necessary norms and transparency on issuance is not suppression of innovation but a foundational protection for users and financial stability. The GENIUS Act’s model—licensed issuers + high-quality 1:1 reserves + mandatory disclosure and audits—and the refusal of U.S. compliant exchanges to list risky stablecoins, send a clear SEO-relevant message:

Only stablecoins willing to operate under legal and accounting sunlight, accepting full scrutiny of reserve structures and fund paths, deserve to become part of payment infrastructure.

In the long run, transparency and compliance will not weaken crypto liquidity; they will attract institutional capital and expand lawful financial activity around stablecoins. True health of the stablecoin market lies not in hiding risks within offshore trusts and funds, but in acknowledging these structures and bringing them back onto tracks of disclosure, responsibility, and predictable governance.